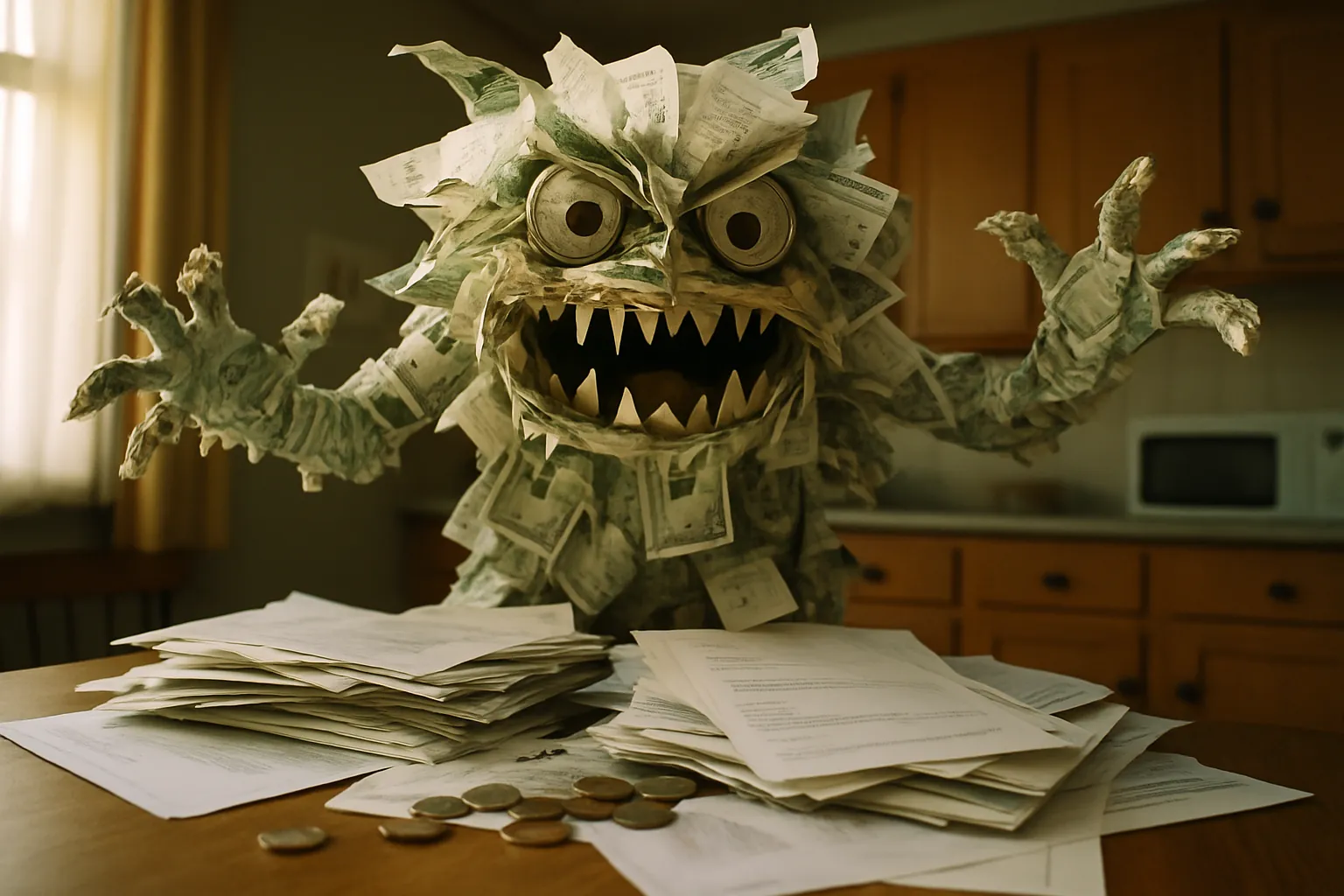

Stop Chasing Every Deal—Why Narrowing Down Just ONE Out-of-Control Bill Could Net You an Extra $70 This Week

Does it feel like every dollar you earn disappears before the week is up? If your cash runs out faster than it used to, you’re not alone. Most Americans are spending more than they earn (Bureau of Economic Analysis). But here’s a secret: Instead of chasing every coupon or discount, zero in on ONE runaway bill this week—like a bloated phone plan, old insurance, or unused cable. Research proves this laser focus can put $70 or more back in your pocket—fast. Here’s exactly how to flip the script on your budget, one bill at a time:

1. Spot Your Budget Buster: Find the Bill Eating Your Lunch

Every family has that one monthly expense that keeps creeping up. It might be your internet, cell phone, or cable. Think: Which bill have you just let auto-pay, even though it keeps rising?

“Customers can save up to 20% on their internet bills by negotiating with their service providers.” (GoAskUncle)

Look for the bill that makes you groan when you open it—that’s your best target.

- Print out or pull up your last 2–3 months of bills.

- Circle the highest or most unfair charge—streaming? Phone? Insurance add-ons?

Action step: Pick one bill for this week—don’t try to fix everything at once.

2. Compare and Scope Out Competitors

If you just let bills autopilot, you’ll pay what they demand. Do a quick online search for what competing companies charge for the same service. Use those numbers as your armor.

“Researching competitor rates and mentioning them during negotiations can lead to better deals from your current service provider.” (U.S. News & World Report)

Bringing real examples makes companies take your call much more seriously.

- Google “best [your service] deals [your area]” (example: internet plans New York).

- Jot down 2–3 lower priced plans or promo offers.

Action step: Write down any special offers or perks competitors give new customers.

3. Make the Call—Negotiate Like a Pro

This is where most people freeze. But did you know being polite—and a little persistent—can unlock real deals? Don’t overthink it: the average negotiation takes less than an hour. For complex bills, consider a free bill negotiation service.

“Bill negotiation services like BillFixers have saved clients over $5 million by negotiating lower rates on bills such as cable, internet, and phone services.” (Wikipedia)

Many providers offer loyalty discounts if you just ask—and mention competitor deals.

- Call your company; say, “I’ve seen better rates elsewhere—can you match or beat them for me as a loyal customer?”

- Be friendly, but firm. If needed, ask to speak with customer retention.

- If you’re too busy or nervous, companies like BillFixers handle this for you (for a cut of your savings, usually 40–50%).

Action step: If the rep says no, ask, “Is there a different department that helps with lower rates or loyalty offers?”

4. Watch for Add-ons, Bundles & Sneaky Charges

Bill shock often comes from sneaky add-ons (like insurance you didn’t approve, or expensive tech support). Ask for a detailed breakdown and drop extras you don’t need. Sometimes, bundling services (like internet and streaming) gets you a much better deal.

“Bundling services, such as combining internet and cable, can lead to significant savings on monthly bills.” (U.S. News & World Report)

Reducing extras or bundling can slash $20–30 or more from your bill instantly.

- Ask: “Please remove all optional add-ons I’m paying for.”

- If you use multiple services, request a bundle offer.

Action step: Always confirm the new rate and the details—get it in writing or email if possible.

5. Set & Forget – Use Your New Savings Right Away

Once you’ve scored a lower bill or dropped pricey extras, reroute that savings instantly. Even $70 a month adds up to $840 a year—a true game-changer for groceries, an emergency fund, or overdue bills.

“Customers who mention competitor offers during negotiations are more likely to receive discounts or promotional rates from their current providers.” (NerdWallet)

Move your savings to a separate spot—don’t let it blend back into everyday spending.

- Set up an automatic monthly transfer to savings for the amount you just freed up.

- Or, put it toward a pressing expense you’ve been putting off—like groceries, rent, or gas.

Action step: Pat yourself on the back—one hour of focus just made your week (and maybe your year) easier!

Bottom Line: Don’t Try to Do It All—Just Win One Battle This Week

Forget clipping every coupon or obsessing over tiny discounts. Zero in on ONE bill that’s gone wild, use competitor deals as leverage, and politely demand a better rate. It’s not magic: Just one hour of effort can realistically put $70 back in your hands this week. Don’t wait—grab your next bill and take charge today. The extra cash is yours for the taking!