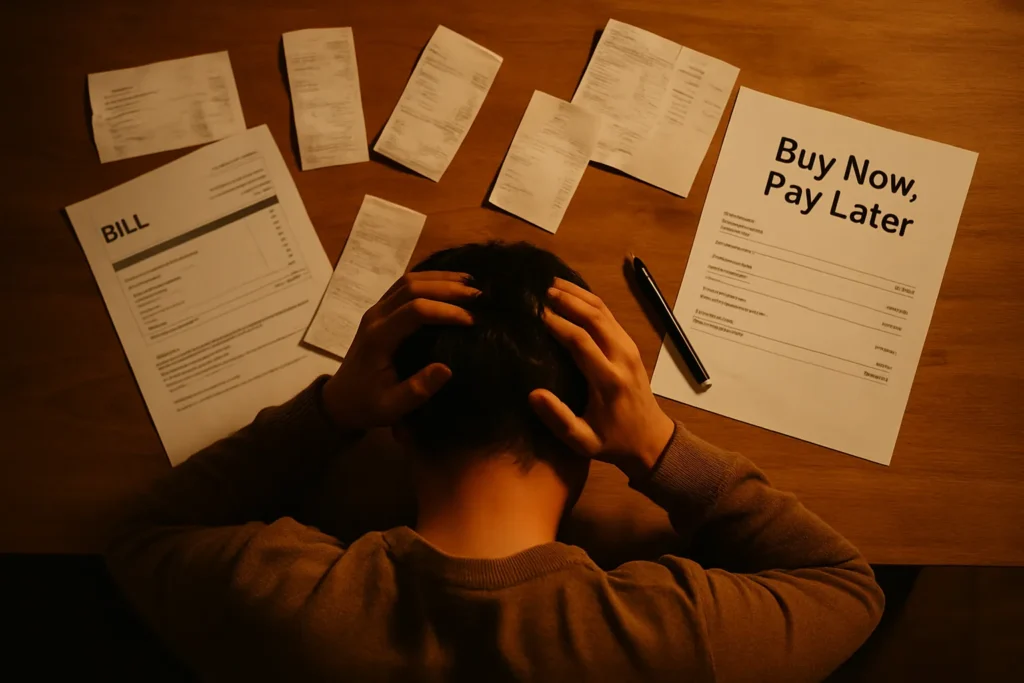

Could Your Buy Now, Pay Later ‘Easy Button’ Actually Be a Debt Trap? 3 Fast Checks Before You Click Again

Buy Now, Pay Later (BNPL) is everywhere—from grocery carts to phone upgrades. Millions love the instant split payments, but surprise late fees, new credit rules, and hidden debt are turning that shiny ‘Easy Button’ risky. Before you check out one more thing, use these three checks to make sure BNPL keeps you in control, not in a financial trap.

1. Affordability Check: Can You Really Pay Off Each BNPL Bill?

Many people swipe through BNPL without thinking if they can truly afford future payments, especially as costs add up.

24% of Americans who used BNPL have made a late payment, up from 18% in 2023 (The Motley Fool).

One missed payment can mean fees or worse, a hit to your credit. With regulators like the UK’s Financial Conduct Authority planning strict ‘affordability checks’ (Reuters), your own check is just as important.

- Before buying, add all monthly installments for your current and planned BNPL purchases.

- If you can’t cover them along with rent, groceries, and essentials, press pause.

- Set a BNPL budget—never use it for items you couldn’t buy with cash.

Still unsure? Ask yourself: “Would I put this on my debit card today, or can it wait?” Commit to your affordability check every time—don’t wait for a lender to do it for you!

2. BNPL Debt Check: Are You Tracking Every Outstanding Payment?

It’s easy to lose track. A pair of shoes here, a gadget there—suddenly, five payment plans pile up.

31% of BNPL users have lost track of payments they owe (The Motley Fool).

Forgetting just one can trigger late fees or ding your credit report as new rules roll out.

- List every BNPL plan (amounts, due dates, next payment).

- Add payment reminders to your calendar or phone.

- Check if later this year your BNPL will be reported to credit bureaus—a late payment could drop your score (Nasdaq).

Take five minutes today—write down all BNPL debts and their next due dates. If the list scares you, it’s time to slow down BNPL spending.

3. Impulse Freeze: Are You Clicking Without Reading the Fine Print?

The BNPL ‘easy button’ is designed for quick clicks, but that’s where costly traps hide. Small type and soft language can bury fees, penalties, and even changes to how your data is used.

The OCC (bank regulator) urges banks to use clear disclosures with BNPL—because confusing terms can trip up customers (Office of the Comptroller of the Currency).

Never click ‘confirm’ unless you know the real cost, number of payments, and what happens if you’re late.

- Before you check out, click to read the BNPL terms and late fee policies.

- Find out if your provider shares data with credit bureaus and third parties.

- If unsure, set a personal “BNPL freeze”—give yourself 24 hours before making any new payment plan purchase.

Regulations are coming, but you’re your own best watchdog. Make the ‘Easy Button’ a ‘Pause Button’—especially on non-essentials.

Wrapping Up: Use These 3 Checks Before Your Next Click

The BNPL surge is real: usage jumped 43% last year and is still rising fast (Amra & Elma). But so is the risk, especially for those not paying close attention. Stay in control: check affordability, track every plan, and freeze before impulse clicks. Take your first step now: write down your BNPL debts and set a spending limit. Next time you see that ‘Easy Button,’ you’ll be ready to hit it wisely—or maybe not at all.